All Categories

Featured

Table of Contents

For the majority of people, the most significant issue with the unlimited banking concept is that initial hit to early liquidity triggered by the prices. Although this disadvantage of boundless financial can be decreased significantly with correct policy layout, the initial years will certainly always be the worst years with any type of Whole Life policy.

That said, there are specific boundless financial life insurance coverage policies made largely for high early cash worth (HECV) of over 90% in the initial year. The long-term performance will certainly frequently substantially delay the best-performing Infinite Financial life insurance policies. Having access to that additional 4 numbers in the very first couple of years may come with the cost of 6-figures down the roadway.

You in fact get some substantial long-lasting benefits that help you recoup these early costs and afterwards some. We find that this prevented very early liquidity issue with unlimited banking is a lot more psychological than anything else as soon as thoroughly discovered. In reality, if they definitely required every dime of the money missing from their boundless financial life insurance policy policy in the first few years.

Tag: unlimited financial principle In this episode, I chat regarding financial resources with Mary Jo Irmen that educates the Infinite Financial Idea. With the increase of TikTok as an information-sharing platform, financial suggestions and methods have actually located an unique method of dispersing. One such method that has actually been making the rounds is the boundless financial idea, or IBC for brief, amassing endorsements from celebs like rap artist Waka Flocka Fire.

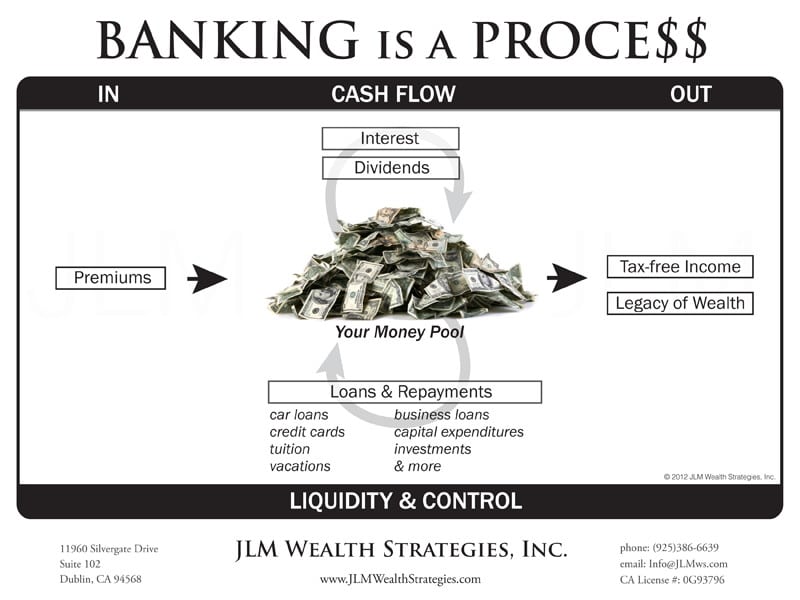

Within these plans, the cash worth expands based on a rate established by the insurance company. When a substantial cash money worth builds up, insurance policy holders can get a cash value financing. These loans differ from conventional ones, with life insurance policy working as security, suggesting one might shed their protection if borrowing exceedingly without appropriate cash worth to sustain the insurance coverage costs.

And while the allure of these plans is apparent, there are innate limitations and dangers, requiring diligent cash worth tracking. The approach's authenticity isn't black and white. For high-net-worth individuals or company owner, particularly those using strategies like company-owned life insurance policy (COLI), the benefits of tax breaks and compound development could be appealing.

Non Direct Recognition Life Insurance

The attraction of infinite financial does not negate its obstacles: Expense: The fundamental requirement, a permanent life insurance policy plan, is costlier than its term equivalents. Eligibility: Not every person receives entire life insurance policy due to rigorous underwriting processes that can exclude those with details health and wellness or way of life conditions. Complexity and threat: The elaborate nature of IBC, combined with its risks, might discourage numerous, specifically when easier and less dangerous alternatives are available.

Alloting around 10% of your regular monthly revenue to the plan is just not possible for most individuals. Part of what you read below is simply a reiteration of what has currently been stated over.

So before you obtain yourself into a circumstance you're not prepared for, understand the adhering to initially: Although the concept is generally marketed as such, you're not actually taking a funding from on your own. If that were the case, you wouldn't have to repay it. Instead, you're obtaining from the insurance provider and have to settle it with rate of interest.

Some social networks posts suggest making use of cash money value from whole life insurance coverage to pay down debt card financial obligation. The concept is that when you repay the financing with interest, the amount will be sent out back to your investments. That's not just how it works. When you repay the finance, a part of that interest goes to the insurance firm.

For the initial several years, you'll be settling the commission. This makes it incredibly hard for your policy to build up value throughout this moment. Entire life insurance policy expenses 5 to 15 times more than term insurance coverage. Most individuals simply can not manage it. Unless you can manage to pay a couple of to several hundred bucks for the following decade or even more, IBC will not function for you.

Your Own Bank

Not everybody must depend entirely on themselves for financial safety and security. If you need life insurance policy, right here are some important tips to think about: Think about term life insurance coverage. These plans provide insurance coverage throughout years with substantial monetary obligations, like home loans, student lendings, or when taking care of young youngsters. Ensure to search for the very best rate.

Copyright (c) 2023, Intercom, Inc. () with Booked Font Style Call "Montserrat". Copyright (c) 2023, Intercom, Inc. (legal@intercom.io) with Scheduled Typeface Call "Montserrat".

Creating Your Own Bank

As a certified public accountant focusing on property investing, I've cleaned shoulders with the "Infinite Banking Concept" (IBC) extra times than I can count. I've even interviewed professionals on the topic. The main draw, other than the obvious life insurance policy benefits, was always the concept of developing cash worth within an irreversible life insurance policy policy and borrowing versus it.

Sure, that makes good sense. However truthfully, I constantly believed that money would certainly be better invested straight on financial investments as opposed to channeling it via a life insurance policy policy Up until I uncovered exactly how IBC can be integrated with an Irrevocable Life Insurance Coverage Count On (ILIT) to develop generational wealth. Allow's start with the basics.

Whole Life Insurance Bank On Yourself

When you obtain against your policy's cash money value, there's no collection repayment routine, offering you the liberty to manage the funding on your terms. The cash money value proceeds to expand based on the plan's guarantees and dividends. This configuration allows you to accessibility liquidity without interrupting the lasting growth of your plan, provided that the lending and passion are taken care of carefully.

The process continues with future generations. As grandchildren are birthed and expand up, the ILIT can acquire life insurance policy plans on their lives also. The count on then accumulates multiple plans, each with growing cash money worths and survivor benefit. With these plans in position, the ILIT efficiently becomes a "Household Bank." Relative can take loans from the ILIT, utilizing the cash money worth of the policies to fund financial investments, start organizations, or cover significant expenditures.

A crucial element of handling this Family Bank is making use of the HEMS requirement, which means "Wellness, Education, Maintenance, or Assistance." This guideline is usually included in count on arrangements to route the trustee on just how they can distribute funds to beneficiaries. By sticking to the HEMS standard, the trust fund ensures that circulations are made for vital requirements and lasting assistance, guarding the depend on's properties while still supplying for member of the family.

Boosted Versatility: Unlike rigid financial institution car loans, you manage the payment terms when obtaining from your own plan. This permits you to framework payments in a manner that aligns with your organization cash money flow. infinite banking wiki. Better Capital: By financing overhead via policy car loans, you can potentially release up cash that would otherwise be connected up in standard loan repayments or equipment leases

He has the same equipment, yet has additionally constructed additional cash money worth in his policy and got tax advantages. Plus, he now has $50,000 available in his policy to make use of for future chances or expenditures. Regardless of its prospective benefits, some people stay doubtful of the Infinite Banking Idea. Let's attend to a couple of typical worries: "Isn't this simply pricey life insurance coverage?" While it's real that the premiums for a properly structured entire life policy might be higher than term insurance policy, it's essential to watch it as more than just life insurance policy.

Becoming Your Own Banker Nash

It's regarding creating a versatile financing system that gives you control and gives multiple advantages. When used purposefully, it can match other investments and business methods. If you're fascinated by the potential of the Infinite Financial Idea for your service, here are some steps to consider: Inform Yourself: Dive much deeper right into the principle through trusted publications, workshops, or appointments with well-informed experts.

Table of Contents

Latest Posts

Cash Flow Banking Reviews

R Nelson Nash Net Worth

Personal Banking Concept

More

Latest Posts

Cash Flow Banking Reviews

R Nelson Nash Net Worth

Personal Banking Concept